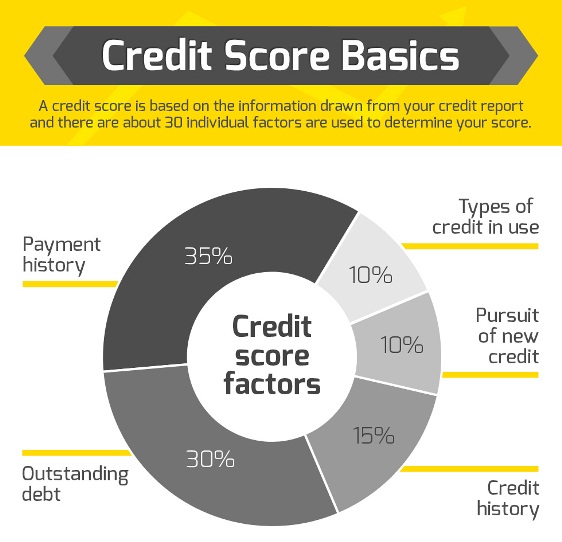

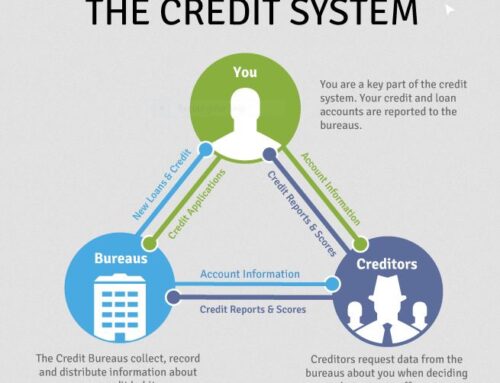

Are you confused with your constantly changing credit score? Every time you check your credit it seems to change, even when you haven’t applied for any new accounts. Why? Don’t worry, I was confused as well until I started really keeping track of my score and how changes to my credit report were affecting it. Maybe your goal is not to become an expert on credit score calculation and optimization, but you still should understand the basics of FICO Score calculation and the 10 FICO Factors used most when calculating your credit score:

1. Your Pursuit of New Credit

That’s right, your pursuit of opening new credit lines will affect your credit score. This can work for or against you. When you’re looking for a new line of credit, don’t apply at 10 places to check and compare rates. It’s true, multiple inquiries within a short period of time has less of an effect, but it can still lower your score, especially if you do this multiple times per year. Be strategic with your applications to minimize the amount of times your credit is pulled – improving your score and chance of approval.

2. Types of Credit Used

Having a good mix of open credit accounts will improve your score as it shows your responsible with all different types of available credit options. The different types of loans or credit you need to have a good mix are: installment loans, revolving credit, and asset-secured loans like mortgages or auto loans. The proper mix of loans can get a little confusing, but start with having open credit in as many different types possible.

3. Length of Credit History

Open your first account as soon as possible! The length of your credit history plays a huge part on your overall score. It’s impossible to fix this without letting time pass, so even if you have to open a secured credit card – do it today to start establishing your credit history. Your length of credit history starts from the first account you open, nothing else changes this credit score factor.

4. Your Percentage of Available Credit

This is starting to get into the more complicated methods used when calculating your credit score. You want to make sure your credit is not maxed out at anytime. Make it simple by trying to keep your open credit balances as low as possible – at all times. This is a really important factor that FICO uses when calculating credit scores, to learn more read my guide on FICO Score Calculation Methods & Secrets.

5. Your Debt To Asset Ratio

As mentioned above, you need to have a good mix of open credit accounts. Your debt to asset ratio takes this one step further by comparing the value of your assets to the amount of debt you have. Asset-based loans like auto loans, mortgages, and secured cards are compared with non-asset based loans such as credit cards, retail cards, and other personal loans. Try to keep a good balance, the more assets you have, the more trusted you will be and your credit opportunities will go through the roof.

Facebook Comments