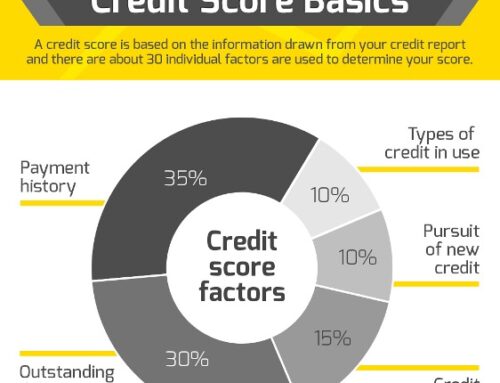

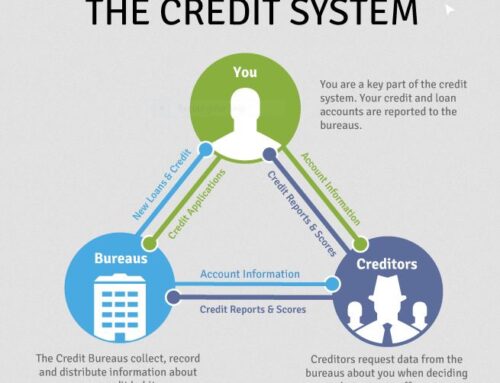

As promised… these are the Real Methods & Unknown Secrets FICO uses when calculating your credit score. If you haven’t read part one of this post, please read it before moving on. It will benefit you greatly to understand the basic methods FICO uses. Even if you think you know the basics, take the few minutes, so you can fully utilize the secrets below.

Now let’s get to the secrets which I learned through personal experience during my credit  score optimization process. When I started the process, I was in a bad place…

score optimization process. When I started the process, I was in a bad place…

My FICO Score was 514 and my goal was 800+

To be 100% honest, I’m still working on achieving my goal. As of the time of this post – I’m at 762.

I tell you this not to discourage you, I just like to be upfront. Boosting my number to 762 has helped me accomplish so much in my life that would have otherwise been unavailable without fixing my FICO Score. Going through this process, working with credit professionals (optional), checking your score every month and anytime your credit report changes… Truly is the only way you learn the secrets I’m about to reveal.

Please, don’t take it for granted. FICO is like Google, constantly changing and improving. These secrets have proven the test of time, they are PROMINENT factors FICO use’s when calculating your credit score. Just as internet search is now customized to your personal search history and location, your FICO score is unique and your custom number.

Disclaimer: Obviously these are just my opinions formed from my years of experiences. They would not be secrets if you could prove they were 100% based from facts. FICO Does not give us the facts, but through our observations and opinions, we can unveil secrets.

3 FICO CREDIT SCORE CALCULATION SECRETS REVEALED…

- Your Percentage Of Available Credit

This is a huge factor in calculating your credit score. You NEVER want your credit to be maxed out. Let’s say you have $5,000 of credit available, PRETEND LIKE YOUR LIMIT IS $4,000! If you can pull it off, make your pretend limit $3,000. Only utilizing 60% of your credit limit will help keep your score as high as possible for your current situation.

- How Many Credit Inquiries & The Timing of Those Inquiries

Don’t be FOOLED into thinking inquiries don’t hurt your credit score – they do! How many times your credit report has been pulled (NOT COUNTING YOUR MONITORING) within the last 24 months can make a 20-50 point swing in your credit score. Be strategic with your applications by doing your research before applying. This minimizes the amount of times your credit is checked, improving your overall score.

- How Often & How Recent Your Address Changes

If you have multiple addresses showing up within a short period of time – it’s a red flag. This doesn’t actually lower your credit score, but the amount of time between moves and the number of times you change addresses is sent to creditors when they pull your report – these numbers are another factor used when giving you the instant green or red light on your application.

As you can see, FICO Scores are not easily calculated. It took me years of monitoring my credit reports and FICO score to feel like I was an expert and had information worth sharing. Make sure you read part 1 of this series, and my other blog posts so you can start reverse-engineering your FICO Score today.

Facebook Comments