Your credit score is the most important three digit number in your life. Credit scores can be confusing when trying to understand how to establish or fix your credit. If you’ve asked yourself these questions, then your in the right place:

Your credit score is the most important three digit number in your life. Credit scores can be confusing when trying to understand how to establish or fix your credit. If you’ve asked yourself these questions, then your in the right place:

- How many credit scores do I actually have?

- How often does my credit score change?

- Do I need to know all three of my credit scores?

- Who uses my credit score?

- How do I make sure my credit score is not going down?

- What’s the big deal with credit scores anyway, isn’t my credit report more important?

Those questions are important, by asking them it shows you’re already on the right track to understanding your credit score and how crucial a number it is to your life.

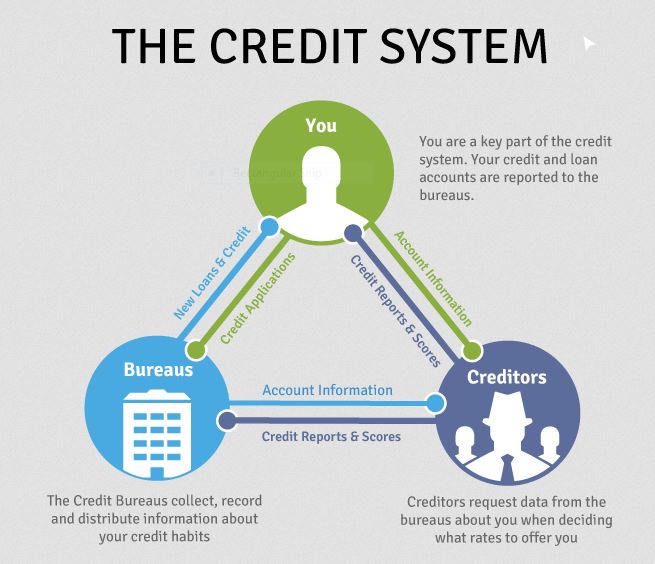

You have three different credit scores calculated by three independent credit reporting agencies.

Credit reporting agencies are for-profit businesses, just like McDonalds or Burger King. The major difference is they obviously hold our fate in their hands. The agencies compile information from creditors then use the FICO Algorithm to determine our personal credit score. The three major credit reporting agencies who calculate your credit score are Equifax, Experian, and TransUnion. These agencies automatically calculate your new credit score whenever a record is updated on your credit report – meaning your credit score can change daily.

Your credit score is more commonly used than your credit report to make approval decisions that affect your life.

Keeping track of your credit score with all three credit reporting agencies is required if you want to know if you’re going to be approved before you apply. It costs money for companies to check your credit so most of them will only check with one or maybe two of the agencies as they determine if their going to extend credit to you. You can usually do some research online and find out what agency the creditor you’re applying with uses and make sure your score is good enough for approval before applying. This makes sure multiple inquiries don’t lower your credit score even further.

Credit Scores can go up or down daily – make sure you apply at the right time to increase your chances of approval.

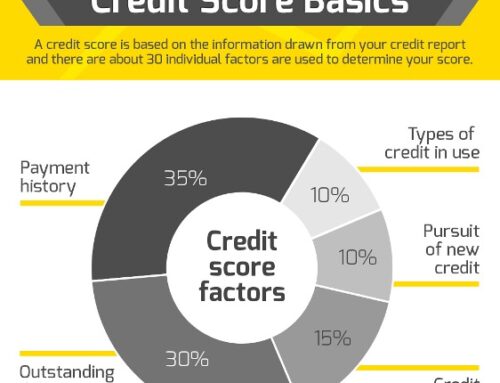

Now you know the basics to credit scores. The next step is to really start understanding how your credit score is calculated. Once you have a solid foundation of knowledge on how your score is calculated, you’ll be able to use monitoring tools to start your credit score optimization and improvement process. If you’re the kind of person who doesn’t care about understanding how stuff works, then skip ahead to my free Fool-Proof Plan To Improve Your Credit Score in 45 Days to start working on your score improvements at home today.

Facebook Comments