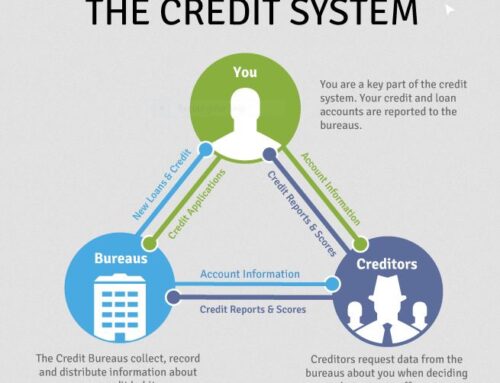

Believe it or not, your credit score is more commonly used by creditors than your actual credit report. Think about this for a second….

You want an additional credit card to boost your purchasing power, so you browse the best offers online, then decide which one to apply for. Within a few seconds, you’re instantly approved or denied. Do you think the bank actually reviewed your entire credit report and instantly made a decision?

Most creditors judge your credit worthiness from your FICO Score, not your credit report.

FICO, less known as the Fair Isaac Company (yes it’s just another corporation), holds all the cards at the credit score table. The creditors and agencies trust FICO to assess your credit, and that’s NEVER going to change. It’s easy to see why you’re FICO Score is so important to your credit. But how is that score calculated?

You most likely have already read the information on the myFICO.com website by now, and learned that their algorithm is a closely guarded secret. No one has access to it, it’s just like the Coca-Cola recipe. The only way to figure out FICO Scores is to actively monitor your credit report and reverse engineer the algorithm. That’s exactly what I’ve been working on ever since I fixed my credit and maximized it’s full potential.

FICO and most other websites tell you the basics, which are important, but they don’t reveal the secrets. Before I tell you the secrets to credit score calculation, let’s make sure the basics are covered.

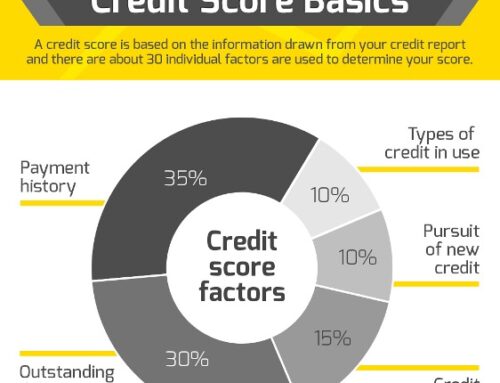

Here is the five basic facts of how your credit score is calculated:

- Payment History – Are you paying your bills on time every month? Do you miss payments? How long does it take you to catch up on late payments?

- Amounts Owed – How much debt do you have? Do you have assets to balance that debt? Is your debt consistently going up?

- Length Of Credit History – When was your first credit account established? Since that time, have you always had open credit?

- New Credit – How many of your accounts are new? Are your new accounts maxed out?

- Types of Credit Used – Is most of your open lines installment loans, mortgage loans, or credit cards?

It’s no lie, these factors do play an important role in determining your FICO credit score. Currently you’re establishing or re-establishing credit, so you need to know the basics as well as the secrets.

Ask yourself the above questions before making decisions that may negatively affect your credit score.

Whenever applying for new credit, our goal is obviously to be approved. To really optimize your FICO score you need to know the secrets. These secrets were not published until now, and I’ve learned them all through personal experience.

Please continue reading Part 2 by clicking here. It’s where I reveal the secrets which helped me optimize my FICO credit score and increase it to new heights.

Facebook Comments