Applying for a new credit card can be a time-consuming and complicated process. It’s so easy to find credit card offers online, we get solicited by our banks to apply for new cards, and mail comes in daily to inform us of pre-approved offers. But does that mean we will actually be approved? If your getting credit card offers in the mail, it means you have decent credit, and have a good chance to get approved! But don’t think that offers received by mail will offer you the best rate. Do you think it’s cheap to send mail to everyone who meets their pre-approval requirements?

You may not be receiving those offers in the mail yet, but don’t worry – you can still get approved

for a new credit card. Almost  anyone can get a credit card, even if they have no credit or bad credit. You may just have to accept a secured or other high interest card if your credit is not that great.

anyone can get a credit card, even if they have no credit or bad credit. You may just have to accept a secured or other high interest card if your credit is not that great.

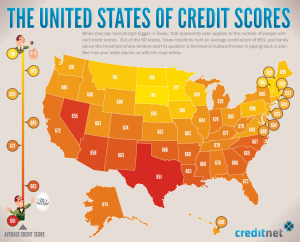

Your credit rating determines how competitive your rate will be and is used by companies to determine how much money they are willing to put at risk.

If you know your credit rating it help you find the most competitive offers for your situation. Learn about the five different credit classifications and see where you rank up:

1. No Credit Established

When you have no established credit you can be a risk to banks and won’t be able to secure the best rates. Your FICO Credit Score is ZERO since they have no information to base your score from. This won’t stop you from getting approved for a new credit card, but it does guarantee the rate your going to get will be through the roof. Brick and mortar banks are hesitant to extend credit to people who have never demonstrated they are responsible enough to make timely payments.

You may find a local credit union that is willing to take the risk. For the best chance at getting approved, it is recommended to go in to a branch in the city you live in. Morning times are better since everyone is chipper and ready for customers to walk through the door. Make sure your looking your best and ready to make a presentation. You want to not only sell yourself, but make a friend out of the banker who is helping you. Don’t walk in and ask for a credit card either, you want to go in with some cash in hand and ask to open a checking and savings account. While you are opening the account, slip in a sly question like “I didn’t know you guy’s offer credit cards, you must need really good credit to be approved, right?”

Credit unions have standard protocols when it comes to opening accounts, but the managers of branches can make a judgement call, especially when you have no past credit to analyze. Having your banker saying “He/She is such a nice person, they do this, have these kids, have family in the community, etc, etc” can help get you approved.

2. Bad Credit Rating

When you have bad credit it can make it very difficult to find offers from credit card companies. Bad credit is anyone with a FICO score under 600. At this stage you should consider repairing your credit so you can get approved for a decent credit card. To start repairing your credit read my Five Required Steps To Start Your Credit Repair Process and Credit Repair Secrets post to get you started on the right track.

If you don’t have the time to repair your credit or require a new credit card today, try out a secured credit card. This eliminates the risk for the bank and help you improve your credit. You will have to secure the card with cash, meaning you give them $500 cash to hold, and they give you a credit card with a $500 credit limit. This can start your credit repair process and help get your rating upgraded to Fair.

Please don’t go out and apply for every credit card offer you can find online, this will only disappoint you with denial after denial, and actually make your credit score worse as well.

3. Fair Credit Rating

Fair credit is a good start and can get you approved today if you pick where to apply carefully. Fair credit is anyone with a FICO score ranging between 601-680. At this point in your credit improvement process you should start with a credit line at your favorite clothes or jewelry store. They are likely to approve you and after 3-6 months of making on time payments you may increase your score and be able to get approved for an actual credit card.

4. Good Credit Rating

Congratulations on knowing how to build your credit. Good credit is anyone with a FICO score ranging between 681-750. If it was back before the financial crisis, you would have been able to get any credit card you wanted. These days you still need to be selective where you apply. If you’re getting pre-approval offers in the mail I would compare them to offers at websites like BankRate.com to see who is accepting good credit applications and apply carefully. Please stay posted to my blog for future posts about offers I find with the most competitive rates for good credit.

5. Excellent Credit Rating

Wow, you finally made it! Excellent credit is anyone with a FICO score ranging between 751-850. Depending on how many open accounts you have, your approval rate will be very high. Pick and choose your offers carefully as you can secure credit cards that have special offers and low ongoing rates. Consider applying for an American Express or Chase Sapphire card to take your credit to the top of the charts. Stay posted to my blog for any special offers I find for excellent credit.

Now you know where you stand on the credit ranking charts. If your goal is to improve your credit further please read through my blog as I am in the process of revealing secrets that nobody offers for free. But please don’t think this site is only for people with bad credit. We are looking for credit experts with excellent credit to contribute in our community and help others improve their credit. With out combined knowledge we can do our part to give back and help others achieve our same level of success.

Facebook Comments