It seems like a simple question, but to tell you the truth, it get’s a little complicated. By asking what is a good credit score,  you already know how important your credit score is to your life dreams. Without a good credit score it can be difficult to rent a house, get a credit card, get bailed out of jail, open a bank account, and even get a job. Yes that’s right, employers across the country are starting to check credit when they do pre-employment background checks.

you already know how important your credit score is to your life dreams. Without a good credit score it can be difficult to rent a house, get a credit card, get bailed out of jail, open a bank account, and even get a job. Yes that’s right, employers across the country are starting to check credit when they do pre-employment background checks.

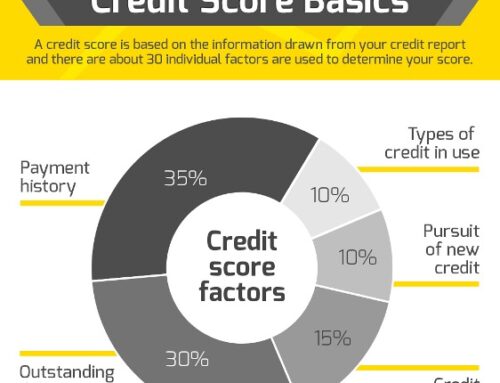

Your credit score is your personal credit ranking determined using standards set by the Fair Isaac Company, more commonly known as FICO. To get back to your question, a good credit score is relevant to your personal situation. That’s why it’s a little more complicated than just giving you score brackets and saying “these are good and bad credit scores.”

If you had a score of 514 last year and now you have a 623, would you consider that a good score?

You should!! Raising your score 100 points in a year is an accomplishment to be proud of. Even though your score would not be considered “good” by the credit score brackets below, you can utilize your rising score to your advantage when applying for an apartment or other situation where your character is being judged as well. Bring in a copy of your credit score when it was 514, show the landlord how seriously dedicated you are to improving your credit score, assure them that you would never do anything to risk the progress you’ve made and you’re the perfect choice for their house as you have learned from your mistakes and never pay your bills late any longer.

Will it increase your chance of getting approved?

Yes it can, especially if your renting from a homeowner and not a property management company.

What if my credit score has been stable at 750 for years now, that’s good right?

Absolutely. You have a solid credit score that can get you approved for most any type of account. Don’t think this is the top though. After the credit crisis, creditors have become more strict on approval standards and you should still work to improve your score to see if you can break 800. You have great credit, but don’t you want to take it to Excellent?

Getting above 800 can be a difficult task, and one that I’m personally still working on myself. When I have some more tips on how to achieve this goal I will post more about how to breakthrough the 760 barrier.

Back to the topic at hand….

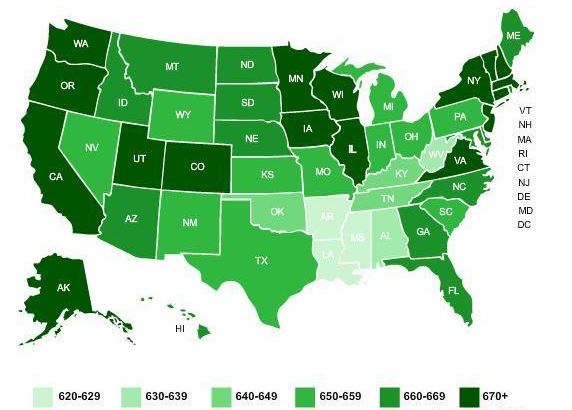

A good credit score is relevant to your personal situation. But for the more common answer here is the score brackets that are typically used in the industry to classify where your credit score ranks:

Are you happy with your current score?

I sure hope not! This is not to discourage you, personally my credit score is above 700, and I’m not happy yet. To learn more about how to improve your credit score here is my top 3 blog posts that you should read:

Facebook Comments